fibonacci in forex

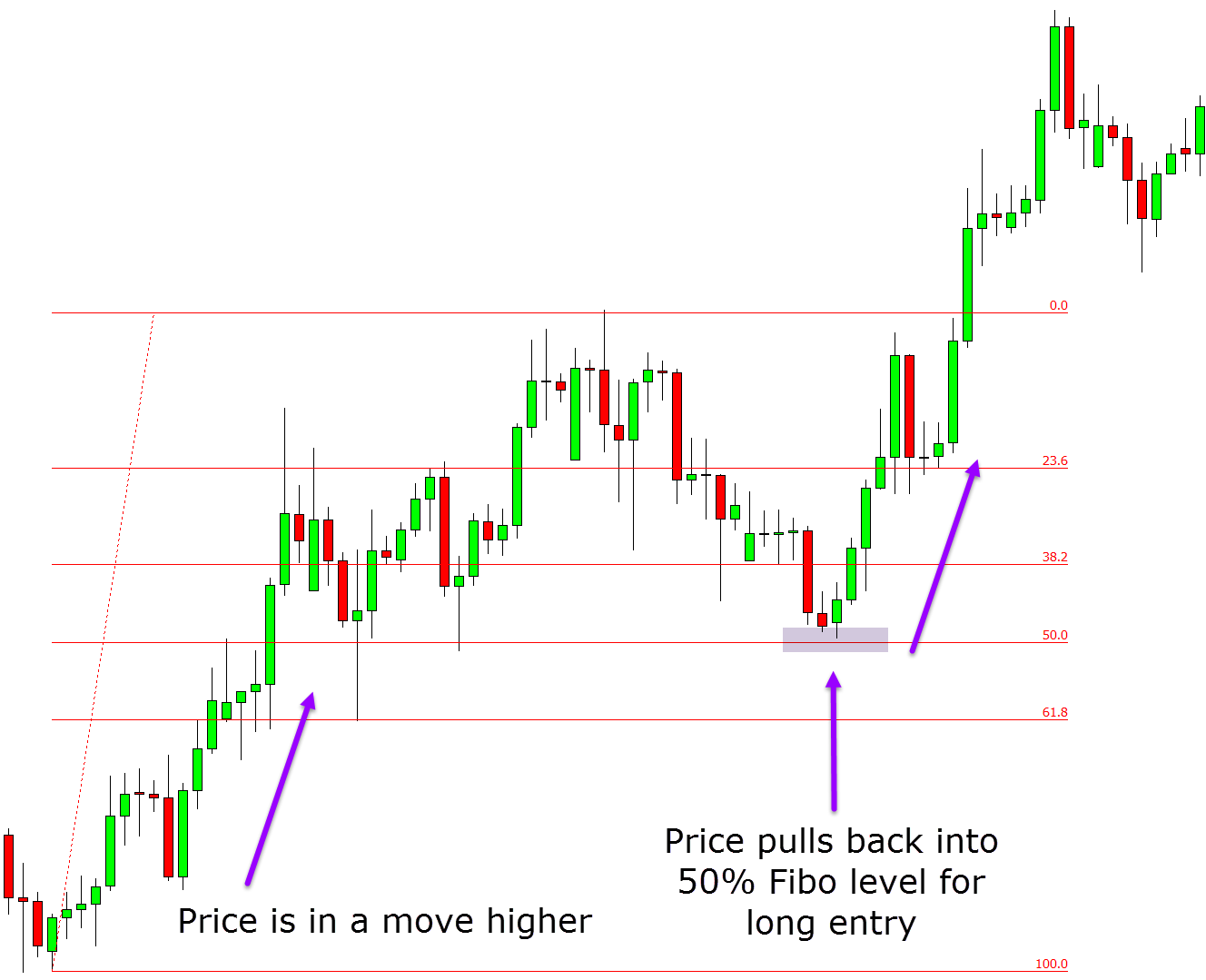

According to Fibonacci theory that countertrend may find support or resistance at a Fibonacci ratio of the initial move. Fibonacci levels are commonly used in forex trading to identify and trade off support and resistance levels.

Beginner S Guide To Fibonacci Forex Trading Strategy

Lets see the primary Fibonacci levels below.

:max_bytes(150000):strip_icc()/dotdash_INV-Fibonacci-Retracement-Levels-June-2021-01-a036f12c487e47e08e14ab42e1f1823b.jpg)

. Then for downtrends click on the Swing High and drag the cursor to. The Fibonacci retracement tool is a huge subject in. The key levels to look out for are the 382 and 618 respectively.

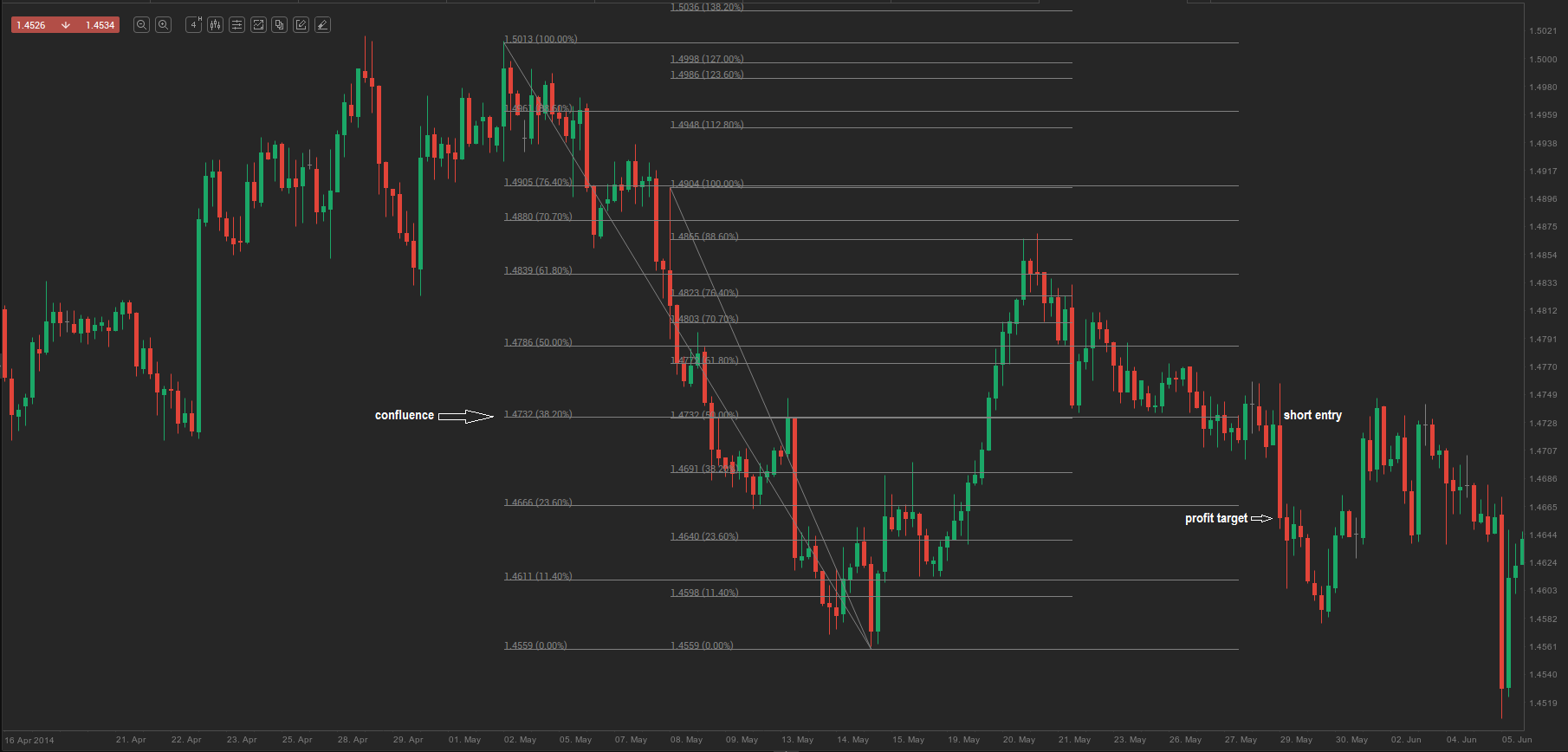

For example 34 divided by 55 equals 618. Here you see that the pair has been in a downtrend so. These levels can be illustrated in three easy steps.

Forex for Beginners. As 618 is a golden percentage so most of the time. Fib traders eventually agreed upon a number of significant ratios that they could use to grid the market up and down in order to plot retracement levels and extension levels.

Fibonacci retracement is widely used in forex trading mainly because of its relative simplicity. Lets go through an example when the Fibonacci retracement tool fails. After a significant price movement up or down the new support.

In other words Fibonacci retracement levels are horizontal lines that point out. Fix the Fibonacci retracement tool to the lower part of the chart and pull it to the right to the. The first category requires an examination of long-term forex trends identifying harmonic levels that triggered major trend changes.

The same principles apply when using Fibonacci levels in forex trading. Below is a 4-hour chart of GBPUSD. The first step is to recognize the main percentages used in a retracement of an upward or downward trend.

In fact in forex trading Fibonacci is a predictive technical analysis indicator used to forecast possible future exchange rate levels. You can add these ratios to any. Active market players will spend more time focused on the second cate See more.

The forex Fibonacci strategy can be quite subjective but due to the fact that so many. You can buy near the 382 percent retracement level with a stop-loss order placed a little below the 50. After the first few numbers in the sequence if you measure the ratio of any number to the succeeding higher number you get 618.

1-800-698-1902 sql server execution plan example. In order to find these Fibonacci retracement levels you have to find the recent significant Swing Highs and Swings Lows. Specify the direction of the Market bullish.

Fibonacci retracement refers to a retracement in price to Fibonacci level 618 or 50 in forex trading technical analysis. Often 236 382 618 or 786. The Forex 618 Fibonacci Forex Trading Strategy is a whole Fibonacci trading system based on the 618 Fibonacci Retracement level.

They are not foolproof. Strategies that utilize Fibonacci retracements include the following. Sometimes when the chart price is in.

Fibonacci grid applications can be roughly divided into two categories historical analysis and trade preparation. The 50 level is not technically a Fibonacci level but is often included in.

Forex Fibonacci Strategy For Daytraders

Combining Two Sets Of Fibonacci Retracements Forex Strategy

Using Fibonacci Retracement Levels To Find Support And Resistance Forex Training Group

Using Fibonacci Clusters To Increase Your Trading Odds Forex Training Group

Why Every Forex Traders Should Learn Fibonacci Retracements

Fibonacci Retracements Strategy For Forex Traders

Retracement Forex Flash Sales 51 Off Ilikepinga Com

Retracement In Forex Trading Fxtm

Fibonacci Bands Forex Strategy

How To Use Fibonacci Retracements Babypips Com

Forex Trading Article Using Fibonacci Ratios For Forex Trading Part 2

Unpopular Opinion The Fibonacci Tool Is Useless Just Convert It Into An Rr Tool For Those Who Disagree Can You Explain The Logic Of The Golden Ratio S Consistency In A Highly Manipulated

What Is Fibonacci In Forex Trading Finance Notes

:max_bytes(150000):strip_icc()/dotdash_INV-Fibonacci-Retracement-Levels-June-2021-01-a036f12c487e47e08e14ab42e1f1823b.jpg)

What Are Fibonacci Retracement Levels And What Do They Tell You

Fibonacci Forex Trading Strategy Fibonacci Retracement Levels